India

Oi-Prakash KL

BJP has strongly criticized Indian Overseas Congress President Sam Pitroda's remarks on “inheritance tax”.

Prime Minister Narendra Modi has described Pitroda's remarks as the grand old party's “dangerous intention” to snatch away people's property and rights, while the Congress has accused the BJP of distorting the remarks.

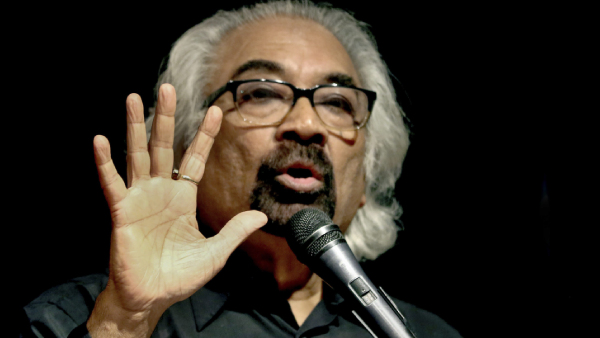

Congress leader Sam Pitroda

What did Sam Pitroda say?

Speaking to ANI, Pitroda shed light on inheritance tax in the US, pointing out that if someone has a net worth of $100 million upon their demise, only 45% can be transferred to their children, The government claims the remaining 55%.

He found the law “interesting” because it embodies a social expectation that individuals should not keep all of their property for their descendants, but should allocate a portion to the public—specifically, half—as they deem appropriate.

In contrast, Pitroda noted the absence of such a tax in India, where if someone with a net worth of $10 billion dies, their children inherit the entire amount, and nothing goes to the public. is saved. He suggests that these are important issues for debate and discussion.

“It says that you created wealth in your generation and now you are leaving, you should leave your wealth to the public, not the whole, not half, which seems fair to me. In India, you don't have that.

If someone's wealth is 10 billion and he dies, his children get 10 billion and the public gets nothing…so these are issues that people have to debate and discuss. I don't know what the conclusion will be at the end of the day but when we talk about redistribution of wealth, we are talking about new policies and new programs that are in the interest of the people and not the super-rich. In interest. Only,” he told the news agency.

What are inheritance taxes?

Inheritance taxes are taxes imposed by the state on assets received by individuals as part of their inheritance. The rules governing inheritance tax vary depending on the beneficiary's relationship to the deceased, the value of the estate and the state in which the deceased lived at the time of his or her passing.

Is there a federal inheritance tax?

No, there is no federal inheritance tax. In fact, only six states impose inheritance taxes.

However, there is a federal estate tax, which is levied on the deceased's estate. In 2024, the first $13,610,000 from an estate is exempt from estate taxes.

Additionally, if beneficiaries sell inherited assets, such as stocks, real estate or valuables, they may be subject to capital gains taxes. The federal capital gains tax rate ranges from 15 percent to 20 percent, depending on the individual's tax bracket.

Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania are states that levy an inheritance tax. However, Iowa is ending the tax in 2025.

How much tax is levied?

Currently six states – Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania – levy an inheritance tax, although Iowa is phasing out its inheritance tax in 2025.

In each state, the tax rate and the persons liable to pay it are different. The tax rate generally ranges from 1 percent to 4 percent. Exemptions are available for spouses, children, stepchildren, parents, grandparents, great-grandchildren, grandchildren, and great-grandchildren. Additionally, charitable organizations are exempt up to $500. (Iowa intends to eliminate its inheritance tax by 2025.)

In Kentucky, the tax rate for estates worth more than $500 or $1,000 ranges from 4 percent to 16 percent, depending on the deceased's relationship. Exemptions apply to spouses, parents, children, stepchildren, grandchildren and siblings.

Whereas in New Jersey, the tax rate ranges from 11 percent to 16 percent, depending on the value of the estate and the relationship to the deceased. Spouses, children, parents, grandparents, grandchildren and charitable organizations are exempt. Siblings and sons/daughter-in-laws are exempt up to $25,000.

Story first published: Wednesday, April 24, 2024, 16:15 (IST)